Analysis of Key Compliance Points in Web3 Mall Development for 2025

- latest articles

- 1.DApp Development & Customization: Merging Diverse Market Needs with User Experience 2.Analysis of the Core Technical System in DApp Project Development 3.How to achieve cross-chain interoperability in Web3 projects? 4.How does the tokenization of points reconstruct the e-commerce ecosystem? 5.How to Set and Track Data Metrics for a Points Mall? 6.What is DApp Development? Core Concepts and Technical Analysis 7.Inventory of commonly used Web3 development tools and usage tips 8.Development of a Distribution System Integrated with Social E-commerce 9.Six Key Steps for Businesses to Build a Points Mall System 10.What is DApp Development? A Comprehensive Guide from Concept to Implementation

- Popular Articles

- 1.Future Trends and Technology Predictions for APP Development in 2025 2.Analysis of the DeFi Ecosystem: How Developers Can Participate in Decentralized Finance Innovation 3.From Zero to One: How PI Mall Revolutionizes the Traditional E-commerce Model 4.DAPP Development | Best Practices for Professional Customization and Rapid Launch 5.Recommended by the Web3 developer community: the most noteworthy forums and resources 6.How to Develop a Successful Douyin Mini Program: Technical Architecture and Best Practices 7.From Cloud Computing to Computing Power Leasing: Building a Flexible and Scalable Computing Resource Platform 8.Shared Bike System APP: The Convenient Choice in the Era of Smart Travel 9.How to Create a Successful Dating App: From Needs Analysis to User Experience Design 10.From Design to Development: The Complete Process of Bringing an APP Idea to Life

With the continuous maturation of blockchain technology and the widespread promotion of the Web3 concept, Web3 marketplaces based on distributed network architecture are gradually entering the public eye. By 2025, as technology further improves and market scale expands, compliance issues have also become a key focus for developers and enterprises. This article will provide a detailed analysis of the compliance essentials in Web3 marketplace development from aspects such as the regulatory environment, data security, smart contracts, digital asset management, cross-border transactions, and user privacy protection, aiming to offer reference and guidance for developers and related businesses.

I. Regulatory Environment and Legal Framework

1.1 Construction of a Multi-level Regulatory System

In the traditional internet era, marketplace platforms mostly relied on centralized server architectures, with regulation primarily focusing on data security and user information protection. In contrast, Web3 marketplaces adopt a decentralized model, eliminating a single entity responsible for regulatory oversight. Faced with this new business model, regulatory agencies in various countries need to establish a multi-level regulatory system. By 2025, regulatory bodies have begun introducing corresponding laws and regulations in areas such as blockchain technology, smart contracts, and digital assets. Developers need to closely monitor local and international regulatory developments to ensure that platform design and operations comply with current legal requirements.

1.2 Legal Applicability and Jurisdictional Issues

Web3 marketplaces operate across national borders, involving legal applicability issues in multiple countries and regions. During development and operation, platforms must conduct detailed analyses of the laws and regulations in each relevant jurisdiction, particularly concerning digital currency payments, digital asset transactions, and cross-border capital flows. Additionally, jurisdictional issues need to be clarified in advance: determining applicable laws and dispute resolution mechanisms in case of conflicts will be a crucial compliance consideration in platform development.

II. Data Security and Privacy Protection

2.1 Data Decentralization and Secure Storage

The core advantages of blockchain technology lie in data immutability and transparency, but they also bring new challenges in data security management. Web3 marketplaces typically use distributed storage solutions for data storage, which enhances data security but requires developers to implement more rigorous designs in data encryption, node verification, and fault tolerance mechanisms. By 2025, regulatory requirements for data security extend beyond preventing hacker attacks to include comprehensive contingency plans for data breaches, data redundancy, and disaster recovery.

2.2 User Privacy Protection and Compliance Requirements

In terms of privacy protection, regions like Europe and the United States have long implemented strict privacy regulations such as GDPR, while domestic and international requirements for personal information protection are becoming increasingly stringent. When designing user registration, identity verification, and transaction record storage, Web3 marketplaces must fully consider user privacy protection. Developers need to employ technical means such as zero-knowledge proofs, multi-signature, and anonymous authentication to protect personal privacy from misuse while ensuring transaction transparency. Additionally, platforms must clearly define the scope of user data usage, storage duration, and data destruction mechanisms to ensure lawful and compliant data processing within legal boundaries.

III. Smart Contract Development and Auditing

3.1 Importance of Smart Contracts and Risk Prevention

Smart contracts are one of the core technologies of Web3 marketplaces, not only automatically executing contract terms but also serving as transaction arbitrators in a decentralized environment. However, once deployed on the blockchain, smart contract code cannot be easily modified, so developers must ensure flawless design. By 2025, the market requires smart contracts to undergo rigorous security audits to prevent code vulnerabilities, logical errors, and security risks. Development teams should engage professional third-party auditing agencies to conduct multiple rounds of testing and promptly address potential risks.

3.2 Development Standards and Compliance Testing

To ensure smart contract compliance, developers need to follow industry best practices and adopt modular, upgradeable design concepts. For example, using proxy contracts enables dynamic upgrades and maintenance. Simultaneously, platforms must establish comprehensive monitoring systems to track smart contract operations in real-time, identifying abnormal transactions and potential risks promptly. Regulatory bodies are also promoting the standardization of smart contracts, potentially leading to unified code standards and auditing processes in the future. This requires developers to plan ahead during development to ensure contract designs meet future compliance requirements.

IV. Digital Asset Management and Transaction Compliance

4.1 Classification and Regulation of Digital Assets

Digital assets involved in Web3 marketplaces include cryptocurrencies, tokens, NFTs, etc., which involve value transfer and ownership changes during transactions. Regulatory policies for digital assets vary by country, with some classifying them as financial products and others as new asset categories. When designing platforms, developers must classify and manage digital assets according to target market laws, clarifying issuance, trading, settlement, and tax treatment processes for each asset type. Additionally, platforms need to establish risk warning mechanisms to monitor abnormal transactions and market manipulation, preventing the spread of financial risks.

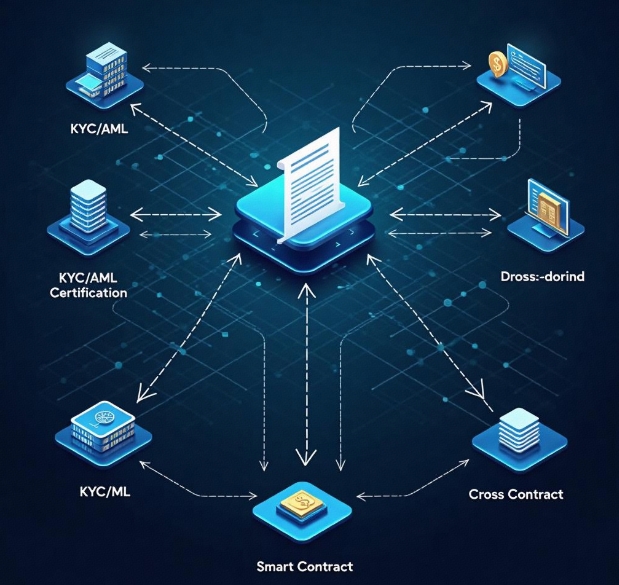

4.2 Implementation of KYC and AML Mechanisms

A crucial aspect of compliance is Anti-Money Laundering (AML) and Know Your Customer (KYC) mechanisms. Although Web3 marketplaces emphasize decentralization and anonymity, platforms must balance compliance requirements with user experience in practice. By 2025, most countries require all platforms involving digital asset transactions to implement KYC/AML measures. Developers should leverage blockchain identity verification technology, integrating KYC processes with smart contracts for automated identity verification and risk assessment. Furthermore, platforms need to establish information-sharing mechanisms with regulatory agencies and financial institutions to ensure effective monitoring of compliant transactions.

V. Cross-border Transactions and International Compliance Challenges

5.1 Cross-border Payments and Exchange Rate Management

The global nature of Web3 marketplaces makes cross-border transactions commonplace. In cross-border payments, developers need to consider exchange rate fluctuations between different national currencies and compliance issues with payment channels. In the 2025 market environment, conversions between digital currencies and fiat currencies will become more frequent, requiring platforms to establish stable exchange rate management mechanisms and collaborate with international payment institutions to ensure secure and timely settlement of cross-border payments. Additionally, when designing payment interfaces, platforms must adhere to regulations from payment regulatory agencies in various countries to ensure transparent and legal payment processes.

5.2 International Compliance Standards and Data Exchange

With the continuous integration of the global digital economy, unified compliance standards are being promoted internationally. When conducting cross-border data exchange and transaction processing, Web3 marketplaces need to refer to international standards such as ISO and PCI-DSS to ensure that platforms meet international levels in data protection, transaction records, and risk management. Particularly when involving cross-border user information transmission, developers should establish data localization strategies to ensure that data storage and exchange processes comply with privacy protection laws in various countries. In the future, regulatory agencies may introduce unified cross-border data exchange protocols, so platforms should预留接口和升级空间 in advance to adapt to evolving regulatory policies.

VI. Balancing Technological Innovation and Compliance

6.1 Emphasizing Both Innovation Drive and Risk Management

The development of Web3 marketplaces relies on technological innovation, with cutting-edge technologies like blockchain, smart contracts, and decentralized identity verification bringing unprecedented convenience and efficiency. However, while pursuing innovation, platforms must confront the associated risks and compliance challenges. Developers need to introduce risk management mechanisms early in product design, use distributed ledger technology to track transactions, and employ technical means to automatically intercept abnormal transactions. Technological innovation and compliance are not opposing forces but can be balanced through scientific management. Only by innovating based on a thorough understanding of compliance requirements can platforms ensure long-term development.

6.2 Industry Standards and Ecosystem Development

Currently, the Web3 field is in a rapid development phase, with industry standards not yet fully unified. To promote the healthy development of the entire ecosystem, major platforms and developers need to actively participate in standard setting and ecosystem building. Through industry alliances, technical seminars, and collaborative projects, stakeholders can share the latest compliance experiences and technological achievements, forming unified regulatory response mechanisms. By 2025, with continuous improvements in technology and regulations, the gradual establishment of industry standards will provide clearer direction for Web3 marketplace development and further enhance the security and transparency of the entire ecosystem.

VII. Future Outlook

Looking ahead, Web3 marketplaces have broad development prospects, but compliance issues will always remain a crucial topic that cannot be ignored. As regulatory agencies strengthen their oversight of blockchain and digital assets, developers need to continuously update technical means and actively adapt to new legal and regulatory requirements. Only by ensuring compliance can technological innovation truly be implemented and benefit users. In the future, regulatory agencies may further enhance international cooperation, introducing more detailed standards and specifications, which will provide clear guidance for Web3 marketplace development and operation, laying the foundation for the healthy development of the entire digital economy ecosystem.

Conclusion

In 2025, as an important representative of the new generation of internet business models, Web3 marketplace development must not only pursue technological innovation but also highly prioritize compliance building. From regulatory environment, data security, smart contracts, and digital asset management to cross-border transactions, every aspect requires developers to exercise precise control, ensuring platform operation is both efficient and secure. Through continuous technological optimization and improvement of compliance mechanisms, Web3 marketplaces are expected to play a greater role in the future digital economy, driving the transformation and progress of global business models. For developers and enterprises, compliance is not only a legal requirement but also key to building user trust and achieving long-term development.

In summary, facing increasingly severe compliance challenges, developers should embrace the future with an open, innovative, and collaborative attitude, achieving a win-win situation between compliance and innovation through continuous optimization of platform architecture and enhancement of technical capabilities. Only in this way can Web3 marketplaces remain invincible in the wave of the digital economy era, truly realizing the dual enhancement of commercial value and social benefits.

-

How does the tokenization of points reconstruct the e-commerce ecosystem?

With the continuous advancement of internet technology and the gradual prolifera···

-

How to Set and Track Data Metrics for a Points Mall?

With the rapid development of the e-commerce industry, points malls, as a common···

-

Development of a Distribution System Integrated with Social E-commerce

With the rapid development of internet technology, the e-commerce industry has e···

Blockchain

Blockchain